"In North America we grew above market in the second half of the year and delivered 37% year-over-year adjusted EBITDA improvement. In EMEA, we moved decisively and made significant progress in applying our commercial and structural cost levers to set us up for a strong year ahead." – Andy Silvernail, Chairman and CEO, International Paper.

"In North America we grew above market in the second half of the year and delivered 37% year-over-year adjusted EBITDA improvement. In EMEA, we moved decisively and made significant progress in applying our commercial and structural cost levers to set us up for a strong year ahead." – Andy Silvernail, Chairman and CEO, International Paper.

Jan. 29, 2026 - International Paper today announced results for the full-year and fourth quarter ended December 31, 2025. The Company separately announced its plan to create two independent, publicly traded packaging solutions companies in North America and EMEA.

See: International Paper to Create Two Independent Public Companies.)

"Throughout 2025, we made significant progress executing our profitable growth strategy," said Chairman and CEO Andy Silvernail. "By deploying and embedding 80/20, we focused resources where we can win and built two regional packaging powerhouses. In North America we grew above market in the second half of the year and delivered 37% year-over-year adjusted EBITDA improvement. In EMEA, we moved decisively and made significant progress in applying our commercial and structural cost levers to set us up for a strong year ahead."

"As we enter 2026, we anticipate meaningful progress on our commercial and cost-out initiatives and expect to deliver $3.5 - $3.7B of adjusted EBITDA for the full year and $740-760 million in the first quarter. These targets are based on above-industry growth but do not reflect future price realization. Further, we have not yet fully assessed the impact of this week's winter storm across the US." Silvernail continued, "We have confidence in the plans to achieve our targets for 2026 and believe our ongoing transformation investments will allow us to build momentum as we work toward forming two scaled, independent, regional packaging solutions leaders in North America and EMEA."

Effective in 2025, the Chief Operating Decision Maker (CODM) began reviewing the Company's financial results and operations under a structure that reflects the scope of the Company's continuing operations: Packaging Solutions North America (PS NA) and Packaging Solutions EMEA (PS EMEA). The PS EMEA segment includes the Company's legacy EMEA Industrial Packaging business and the EMEA DS Smith business. As such, amounts related to the Company's legacy EMEA Industrial Packaging business have been recast out of the Industrial Packaging segment into the new PS EMEA segment for all prior periods. The North America DS Smith business has been included in the PS NA segment. Amounts related to the Company's legacy North America Industrial Packaging business have been reported in the PS NA segment for all prior periods. This decision followed completion of our acquisition of DS Smith on January 31, 2025.

Following the announcement of a definitive agreement to sell the Global Cellulose Fibers (GCF) business on August 21, 2025, the GCF business is no longer a reportable segment. All current and historical operating results of the GCF business are presented as Discontinued Operations, net of tax, in the condensed consolidated statement of operations. For discussion of discontinued operations, see the disclosure under Discontinued Operations and Consolidated Statement of Operations and related notes included later in this release.

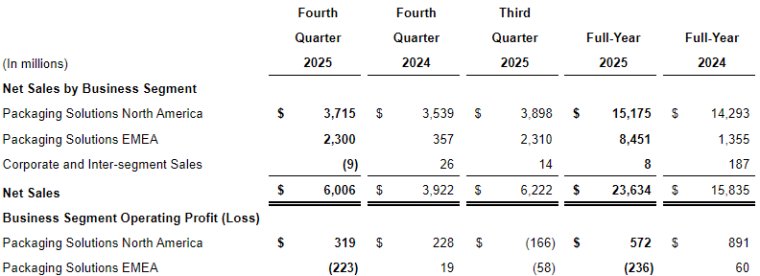

The following table presents net sales and business segment operating profit (loss), which is the Company's measure of segment profitability. Business segment operating profit (loss) is a measure reported to our management for purposes of making decisions about allocating resources to our business segments and assessing the performance of our business segments and is presented in our financial statement footnotes in accordance with ASC 280 - "Segment Reporting". Fourth quarter 2025 net sales by business segment and operating profit (loss) by business segment compared with the third quarter of 2025 and the fourth quarter of 2024 along with full-year 2025 net sales by business segment and operating profit (loss) by business segment compared with full-year 2024 are as follows:

Packaging Solutions North America (PS NA) business segment operating profit (loss) in the fourth quarter of 2025 was $319 million compared with $(166) million in the third quarter of 2025. In the fourth quarter of 2025, net sales decreased driven by lower volumes due to exiting the non-strategic export containerboard and specialty markets and three fewer shipping days. These impacts were partially offset by higher sales prices for boxes and strategic customer wins. Cost of products sold decreased due to lower sales volumes and operating costs, including the cost-out impact of our mill strategic actions and lower input costs, partially offset by higher planned maintenance outage costs. Depreciation and amortization in the fourth quarter of 2025 was lower due to the non-repeat of $619 million of accelerated depreciation associated with the previously announced closures of the Red River containerboard mill in Campti, Louisiana and the Savannah and Riceboro containerboard mills in Georgia in the third quarter of 2025.

Packaging Solutions EMEA (PS EMEA) business segment operating profit (loss) in the fourth quarter of 2025 was $(223) million compared with $(58) million in the third quarter of 2025. Net sales decreased in the fourth quarter of 2025 compared with the third quarter of 2025, reflecting lower sales prices and lower volumes in a continued soft demand environment. Cost of products sold decreased driven by lower fiber and energy costs and lower planned maintenance outage costs. Depreciation and amortization expense in the fourth quarter of 2025 was higher primarily due to the finalization of the valuation of assets and changes to estimated lives associated with the acquisition accounting of DS Smith. Depreciation and amortization expense was also impacted by $73 million of accelerated depreciation associated with mill and plant closures in the fourth quarter of 2025 compared with $56 million in the third quarter of 2025.

In a separate press release today, the Company announced its intent to form two independent, public companies through the separation of its PS NA and PS EMEA businesses. This decisive action is intended to create two scaled, regional packaging solutions leaders, each with focused management teams and business models, tailored investment and capital allocation strategies, and compelling financial profiles. The separation is expected to be completed in 12-15 months, subject to the satisfaction of certain customary conditions.

In conjunction with our annual strategic review, including our evaluation to separate into two independent, public companies, we measured the current fair value of both PS NA and PS EMEA relative to their carrying values. Based on the results of this analysis and in accordance with US GAAP, the company recorded a pre-tax, non-cash goodwill impairment charge of $2.47 billion as of December 31, 2025 related to the PS EMEA reporting unit.

Net special items include items considered by management to not be reflective of the Company's underlying operations. Net special items in the fourth quarter of 2025 amount to a net after-tax charge of $2.32 billion ($4.41 per diluted share) compared with a net after-tax charge of $53 million ($0.15 per diluted share) in the fourth quarter of 2024 and a net after-tax charge of $205 million ($0.39 per diluted share) in the third quarter of 2025.

As announced on January 23, 2026, the Company completed the sale of its GCF business to American Industrial Partners (AIP) for $1.5 billion, subject to customary closing conditions. As part of the consideration, the Company will receive preferred stock in the acquiring entity with an initial liquidation preference of $190 million. In connection with our decision to divest the GCF business, we evaluated the carrying value of the related long-lived assets and determined that their fair value less costs to sell was below carrying value. Accordingly, we recorded an impairment charge in 2025 for a total of $1.07 billion.

International Paper (NYSE:IP; LSE: IPC) is the global leader in sustainable packaging solutions. With company headquarters in Memphis, Tennessee, and EMEA (Europe, Middle East and Africa) headquarters in London, UK, IP employs more than 65,000 team members and serves customers around the world with operations in more than 30 countries.

SOURCE: International Paper