"Demand for sustainable and circular packaging solutions is accelerating globally . . . We experienced strong demand trends once again during the third quarter and backlogs remain elevated. – Mike Doss, President and CEO, Graphic Packaging Holding Company.

"Demand for sustainable and circular packaging solutions is accelerating globally . . . We experienced strong demand trends once again during the third quarter and backlogs remain elevated. – Mike Doss, President and CEO, Graphic Packaging Holding Company.

Oct. 26, 2021 - Graphic Packaging Holding Company (NYSE: GPK), (the "Company"), a leading provider of sustainable fiber-based consumer packaging solutions to food, beverage, foodservice, and other consumer products companies, today reported Net Income for third quarter 2021 of $73 million, or $0.24 per share, based upon 309 million weighted average diluted shares. This compares to third quarter 2020 Net Income of $64 million, or $0.23 per share, based upon 278 million weighted average diluted shares.

The third quarters of 2021 and 2020 were negatively impacted by a net $32 million and a net $8 million of special charges, respectively. The charges are detailed in the Reconciliation of Non-GAAP Financial Measures table attached. When adjusting for charges, Adjusted Net Income for the third quarter of 2021 was $105 million, or $0.34 per diluted share. This compares to third quarter 2020 Adjusted Net Income of $72 million, or $0.26 per diluted share.

Michael Doss, the Company's President and CEO said, "Demand for sustainable and circular packaging solutions is accelerating globally and we are proud to be the fiber-based consumer packaging provider driving ongoing innovation and meeting the call for more sustainable packaging alternatives. We experienced strong demand trends once again during the third quarter and backlogs remain elevated. Supply chain and labor market constraints impacted our ability to meet customer demand in the quarter, and as a result, we experienced approximately $25 million in delayed sales. Our teams worked tirelessly to minimize the impacts of the challenging supply environment and I am pleased with our overall performance. The Foodservice business continued to recover, with sales improving 11% year over year, while Food, Beverage and Consumer grew 3%. Commodity input cost inflation accelerated during the quarter and, as such, we have been executing multiple price actions to offset the inflation we have encountered this year."

Doss added, "We have received all of the necessary regulatory approvals for our previously announced AR Packaging acquisition, which we expect will close on November 1st. At the same time, our transformational CRB optimization project is on track, with coated recycled paperboard production to begin on our new K2 machine in Kalamazoo, Michigan in the 4th quarter. Completion of these two large, transformational investments extends our industry leadership through increased global reach and market expansion, advanced innovation capabilities and a strengthened competitive position across all three paperboard substrates. Growth and returns from the successful execution of these investments coupled with continued strong demand for fiber-based packaging, provide us confidence in next year's projected Adjusted EBITDA of at least $1.4 billion and the resulting cash flow growth which will allow us to quickly deleverage following the successful close of the AR Packaging transaction."

Net Sales increased 5% to $1,782 million in the third quarter of 2021, compared to $1,698 million in the prior year period. The $84 million increase was driven by $53 million of pricing, $20 million of improved volume/mix and $11 million of foreign exchange.

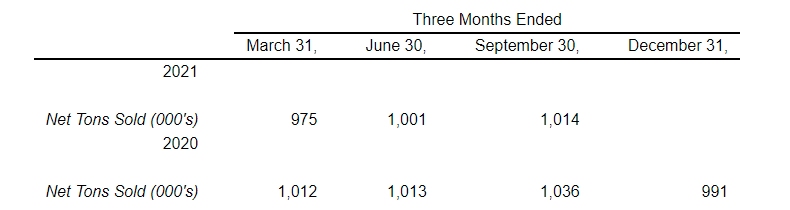

Below is supplemental data highlighting Net Tons Sold for the first three quarters of 2021 and for each quarter of 2020.

The three months ended September 30, 2020 included 7,400 tons sold that did not reoccur in the three months ended September 30, 2021 due to the closing of the White Pigeon, Michigan mill and the shutdown of the West Monroe containerboard machine. The three months ended June 30, 2020 included 27,200 tons sold that did not reoccur in the three months ended June 30, 2021. The three months ended March 31, 2020 included 42,100 tons sold that did not reoccur in the three months ended March 31, 2021.

EBITDA for the third quarter of 2021 was $246 million, compared to $241 million in the prior year period. After adjusting both periods for business combinations and other special charges, Adjusted EBITDA was $284 million in the third quarter of 2021 versus $250 million in the third quarter of 2020. When comparing against the prior year quarter, Adjusted EBITDA in the third quarter of 2021 was positively impacted by $53 million in favorable pricing, $3 million of volume/mix and $79 million in net performance. Adjusted EBITDA was unfavorably impacted by $88 million of commodity input cost inflation and $13 million of labor, benefits and other inflation.

Total Debt (Long-Term, Short-Term and Current Portion) increased $394 million during the third quarter of 2021 to $4,182 million compared to the second quarter of 2021. Total Net Debt (Total Debt, net of Cash and Cash Equivalents) increased $416 million during the third quarter of 2021 to $4,115 million compared to the second quarter of 2021. The Company returned $23 million in capital to stakeholders in the third quarter of 2021 in dividends. The Company's third quarter 2021 Net Leverage Ratio was 3.97 times Adjusted EBITDA compared to 3.69 times at the end of second quarter 2021.

At September 30, 2021, the Company had available liquidity of $1,846 million, including the undrawn availability under its global revolving credit facilities.

Net Interest Expense was $29 million in the third quarter of 2021 as compared to $32 million reported in the third quarter of 2020. Capital expenditures for the third quarter of 2021 were $242 million, up compared to $119 million in the third quarter of 2020, largely due to the new recycled paperboard machine and work necessary to complete the CRB optimization project in Kalamazoo, Michigan. Third quarter 2021 Income Tax Expense was $20 million, up compared to $8 million in the third quarter of 2020, as the prior year period benefitted from favorable outcomes of tax planning.

Graphic Packaging's complete third quarter 2021 report can be found on the company's website: www.graphicpkg.com.

Graphic Packaging Holding Company (NYSE: GPK), headquartered in Atlanta, Georgia, is committed to providing consumer packaging that makes a world of difference. The Company is a leading provider of sustainable paper-based packaging solutions for a wide variety of products to food, beverage, foodservice, and other consumer products companies. The Company operates on a global basis, is one of the largest producers of folding cartons and paper-based foodservice products in the United States, and holds leading market positions in coated recycled paperboard, coated unbleached kraft paperboard and solid bleached sulfate paperboard. To learn more, visit: www.graphicpkg.com.

SOURCE: Graphic Packaging Holding Company

Paper Industry Newsletter

Stay on top of paper industry news

from around the world with

PaperAge's free weekly newsletter.

Delivered every Thursday.

Sign up today!