"Strong demand continued across our markets in the second quarter as consumer preferences are driving conversions to our fiber-based packaging solutions." – Mike Doss, President and CEO, Graphic Packaging Holding Company.

"Strong demand continued across our markets in the second quarter as consumer preferences are driving conversions to our fiber-based packaging solutions." – Mike Doss, President and CEO, Graphic Packaging Holding Company.

July 27, 2021 - Graphic Packaging Holding Company (the "Company") today reported Net Income for second quarter 2021 of $38 million, or $0.13 per share, based upon 295.8 million weighted average diluted shares. This compares to second quarter 2020 Net Income of $52 million, or $0.19 per share, based upon 280.5 million weighted average diluted shares.

The second quarters of 2021 and 2020 were negatively impacted by a net $38 million and a net $20 million of special charges, respectively. The charges are detailed in the Reconciliation of Non-GAAP Financial Measures table attached. When adjusting for charges, Adjusted Net Income for the second quarter of 2021 was $76 million, or $0.26 per diluted share. This compares to second quarter 2020 Adjusted Net Income of $72 million, or $0.26 per diluted share.

Michael Doss, the Company's President and CEO said, "Strong demand continued across our markets in the second quarter as consumer preferences are driving conversions to our fiber-based packaging solutions. Increased consumer mobility and consumption outside of the home resulted in higher sales in our Foodservice markets up 22% year over year, while Food, Beverage and Consumer markets continued to show healthy growth of 4%. Our teams worked tirelessly to meet customer demand, and we swiftly implemented pricing actions to offset rising commodity input costs which impacted our results in the quarter.

"We expect to generate significantly higher Adjusted EBITDA in the second half of 2021 driven by price-cost recovery from the successful execution of approximately $400 million of implemented and recognized pricing actions, and continued momentum from organic sales growth and strong productivity. As we address the near-term inflationary headwinds, we remain unwavering in our commitment to introduce new and innovative packaging solutions across global markets supportive of the move to a more circular economy."

Doss added, "Sustainable packaging is increasingly a factor for consumers when deciding what products to purchase. We are focused on providing the best packaging solutions for consumers through our innovative 'design for the environment' approach and extending our capabilities and geographic reach with strategic acquisitions. We recently closed the Americraft Carton acquisition, gaining seven well-capitalized converting facilities in North America, and I am pleased to welcome this outstanding group of talented employees to our Company. The regulatory approval processes for our announced acquisition of AR Packaging are underway and we anticipate closing that transaction by year end."

Net Sales increased 8% to $1,737 million in the second quarter of 2021, compared to $1,611 million in the prior year period. The $126 million increase was driven by $76 million of improved volume/mix related to organic growth from conversions to fiber-based packaging solutions, $14 million of pricing and $36 million of favorable foreign exchange.

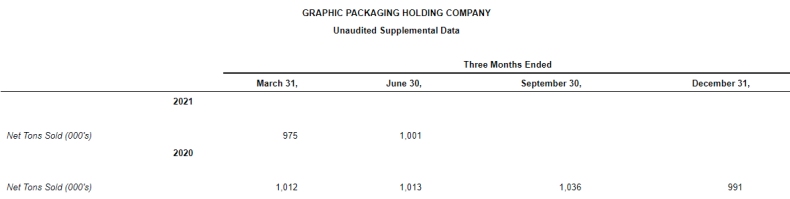

Below is supplemental data highlighting Net Tons Sold for the first and second quarters of 2021 and for each quarter of 2020.

The three months ended June 30, 2020 included 27,200 tons sold that did not reoccur in the three months ended June 30, 2021 due to the closing of the White Pigeon, Michigan mill and the shutdown of the West Monroe containerboard machine. The three months ended March 31, 2020 included 42,100 tons sold that did not reoccur in the three months ended March 31, 2021.

EBITDA for the second quarter of 2021 was $214 million. After adjusting both periods for business combinations and other special charges, Adjusted EBITDA was $248 million in the second quarter of 2021 versus $260 million in the second quarter of 2020. When comparing against the prior year quarter, Adjusted EBITDA in the second quarter of 2021 was positively impacted by $36 million in net productivity, $15 million of volume/mix, $14 million of price and $4 million of favorable foreign exchange. Adjusted EBITDA was unfavorably impacted by $67 million of commodity input cost inflation and $14 million of other inflation.

Total Debt (Long-Term, Short-Term and Current Portion) decreased $77 million during the second quarter of 2021 to $3,788 million compared to the first quarter of 2021. Total Net Debt (Total Debt, net of Cash and Cash Equivalents) decreased $50 million during the second quarter of 2021 to $3,699 million compared to the first quarter of 2021. The Company returned $24 million in capital to stakeholders in the second quarter of 2021 through dividends and partnership distributions. The Company's second quarter 2021 Net Leverage Ratio was 3.69 times Adjusted EBITDA compared to 3.26 times at the end of 2020.

At June 30, 2021, the Company had available liquidity of $1,883 million, including the undrawn availability under its global revolving credit facilities.

Net Interest Expense was $29 million in the second quarter of 2021 as compared to $30 million reported in the second quarter of 2020. Capital expenditures for the second quarter of 2021 were $200 million compared to $154 million in the second quarter of 2020. Second quarter 2021 Income Tax Expense was $26 million, compared to $18 million in the second quarter of 2020.

Graphic Packaging's complete second quarter 2021 report can be found on the company's website: www.graphicpkg.com.

Graphic Packaging Holding Company (NYSE: GPK), headquartered in Atlanta, Georgia, is committed to providing consumer packaging that makes a world of difference. The Company is a leading provider of sustainable paper-based packaging solutions for a wide variety of products to food, beverage, foodservice, and other consumer products companies. The Company operates on a global basis, is one of the largest producers of folding cartons and paper-based foodservice products in the United States, and holds leading market positions in coated recycled paperboard, coated unbleached kraft paperboard and solid bleached sulfate paperboard. To learn more, visit: www.graphicpkg.com.

SOURCE: Graphic Packaging Holding Company

Paper Industry Newsletter

Stay on top of paper industry news

from around the world with

PaperAge's free weekly newsletter.

Delivered every Thursday.

Sign up today!