"The underlying robust demand environment and resulting volume and pricing momentum we have coming out of the quarter are excellent and position us for a very strong second half of 2021." – Mike Doss, President and CEO, Graphic Packaging Holding Company.

"The underlying robust demand environment and resulting volume and pricing momentum we have coming out of the quarter are excellent and position us for a very strong second half of 2021." – Mike Doss, President and CEO, Graphic Packaging Holding Company.

April 28, 2021 - Graphic Packaging Holding Company [on April 27] reported Net Income for first quarter 2021 of $54 million, or $0.19 per share, based upon 277.2 million weighted average diluted shares. This compares to first quarter 2020 Net Loss of $13 million, or $0.04 per share, based upon 288.9 million weighted average diluted shares.

The first quarters of 2021 and 2020 were negatively impacted by a net $11 million and a net $104 million of special charges, respectively, including a net $90 million non-cash charge related to the settlement of a U.S. pension plan in first quarter 2020. The charges are detailed in the Reconciliation of Non-GAAP Financial Measures table attached. When adjusting for charges, Adjusted Net Income for the first quarter of 2021 was $65 million, or $0.23 per diluted share. This compares to first quarter 2020 Adjusted Net Income of $91 million or $0.31 per diluted share.

Michael Doss, the Company's President and CEO said, "Consumer preferences for sustainable packaging are driving global demand for fiber-based packaging solutions. We are meeting this demand by introducing new innovative products and supporting our customers as we answer the calls from today's consumer.

"During the first quarter we continued to deliver on our ambitious growth strategy, increasing net organic sales by 2%. Our team's agility and resolve in executing on our commitments to customers, coupled with the competitive advantages of our vertically integrated platform, allow us to provide continuity of supply while managing a challenging supply chain environment.

"The underlying robust demand environment and resulting volume and pricing momentum we have coming out of the quarter are excellent and position us for a very strong second half of 2021. We are focused on capturing ongoing organic growth from the continued move to more circular and sustainable packaging alternatives and achieving our Vision 2025 for all stakeholders."

Doss added, "Today, I am very pleased to announce our intent to acquire Americraft Carton, a company built on a long history of sustainability and exceptional customer service. Their business philosophy is aligned with how we lead our business. The combination extends our end markets and customer base, further strengthening our position as the leading, integrated paperboard packaging provider in North America."

The Company intends to acquire Americraft Carton, Inc. for approximately $280 million. The proposed acquisition is expected to add approximately $200 million in sales, $30 million in Adjusted EBITDA and significant opportunities for paperboard integration upon completion. Synergies are expected to contribute an additional $10 million of Adjusted EBITDA within 24 months of closing. The transaction includes seven well-capitalized converting facilities and an outstanding team of dedicated employees.

Net Sales

Net Sales increased 3% to $1,649 million in the first quarter of 2020, compared to $1,599 million in the prior year period. The $50 million increase was driven by $33 million of improved volume/mix related to organic growth from conversions to fiber-based packaging solutions and acquisitions, partially offset by fewer selling days when compared to leap year in the prior year quarter, and $20 million of favorable foreign exchange. These benefits were partially offset by $3 million of pricing.

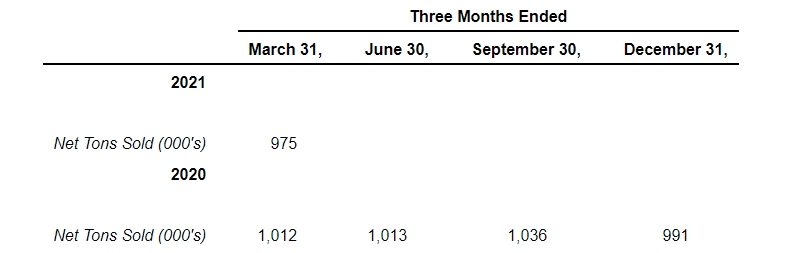

The three months ended March 31, 2020 included 42,100 tons sold that did not reoccur in the three months ended March 31, 2021 due to the closing of the White Pigeon, Michigan mill and the shutdown of the West Monroe containerboard machine.

EBITDA

EBITDA for the first quarter of 2021 was $228 million, or $104 million higher than the first quarter of 2020. After adjusting both periods for business combinations and other special charges, Adjusted EBITDA was $240 million in the first quarter of 2021 versus $295 million in the first quarter of 2020. When comparing against the prior year quarter, Adjusted EBITDA in the first quarter of 2021 was positively impacted by $21 million in net productivity and $5 million of favorable foreign exchange. Adjusted EBITDA was unfavorably impacted by $3 million of pricing, $2 million of volume/mix, $34 million of commodity input cost inflation, $13 million of other inflation and $29 million of costs associated with Winter Storm Uri.

Other Results

Total Debt (Long-Term, Short-Term and Current Portion) increased $198 million during the first quarter of 2021 to $3,865 million compared to the fourth quarter of 2020. Total Net Debt (Total Debt, net of Cash and Cash Equivalents) increased $261 million during the first quarter of 2021 to $3,749 million compared to the fourth quarter of 2020. The Company returned $174 million in capital to stakeholders in the first quarter 2021 through dividends, distributions and partnership redemptions. The Company's first quarter 2021 Net Leverage Ratio was 3.69 times Adjusted EBITDA compared to 3.26 times at the end of 2020.

At March 31, 2021, the Company had available liquidity of $1,444 million, including the undrawn availability under its global revolving credit facilities. The Company issued $800 million of 0.8% and 1.5% senior secured notes and borrowed $425 million under the Farm Credit system, with proceeds used to retire $425 million of higher interest rate bonds, during the quarter.

Net Interest Expense was $30 million in the first quarter of 2021, lower when compared to $34 million reported in the first quarter of 2020, reflecting reduced average borrowing rates. Capital expenditures for the first quarter of 2021 were $146 million compared to $154 million in the first quarter of 2020. First quarter 2021 Income Tax Expense was $18 million, compared to a $5 million benefit in the first quarter of 2020.

Graphic Packaging's complete first quarter 2021 report can be found on the company's website: www.graphicpkg.com.

Graphic Packaging Holding Company (NYSE: GPK), headquartered in Atlanta, Georgia, is committed to providing consumer packaging that makes a world of difference. The Company is a leading provider of sustainable paper-based packaging solutions for a wide variety of products to food, beverage, foodservice, and other consumer products companies. The Company operates on a global basis, is one of the largest producers of folding cartons and paper-based foodservice products in the United States, and holds leading market positions in coated recycled paperboard, coated unbleached kraft paperboard and solid bleached sulfate paperboard. To learn more, visit: www.graphicpkg.com.

SOURCE: Graphic Packaging Holding Company

Paper Industry Newsletter

Stay on top of paper industry news

from around the world with

PaperAge's free weekly newsletter.

Delivered every Thursday.

Sign up today!