Recently, Stora Enso announced the permanent closure of two facilities operating in the woodfree uncoated, mechanical grades and newsprint segments in Finland and Sweden.

Recently, Stora Enso announced the permanent closure of two facilities operating in the woodfree uncoated, mechanical grades and newsprint segments in Finland and Sweden.

Author: Fisher International

May 4, 2021 - The ground continues to shift across the EU as demand patterns in the woodfree uncoated (WFU) segment have driven manufacturers to make some difficult decisions. Most recently, Stora Enso announced the permanent closure of two facilities operating in the WFU, mechanical grades and newsprint segments in Finland and Sweden. Pulp and paper production at the two facilities is scheduled to cease in 3Q2021.

The planned closures will reduce Stora Enso's paper production capacity by 35% to 2.6 million tonnes per year (tpy) and come at a time when EU manufacturers are forced to match production to the declining demand trends that have accelerated during the COVID-19 pandemic.

Per FisherSolve, the Veitsiluoto mill in Kemi, Finland has a total capacity of 732,420 MTPY via three paper machines; two machines produce WFU papers for office use and one machine produces coated paper grades for other print and packaging applications. Additionally, the mill has an integrated chemical pulp mill (414,000 ADMTPY), groundwood mill and a sheeting plant, as well as a functional sawmill. The planned closure of the site will impact all business segments aside from the sawmill, which will continue operations.

The Kvarnsveden mill in Borlänge, Sweden has two paper machines with a total capacity of 550,000 MTPY of supercalendered (SC) magazine papers and improved newsprint. The mill also has an integrated softwood thermomechanical pulp (TMP) line with a total capacity of 368,340 ADMTPY.

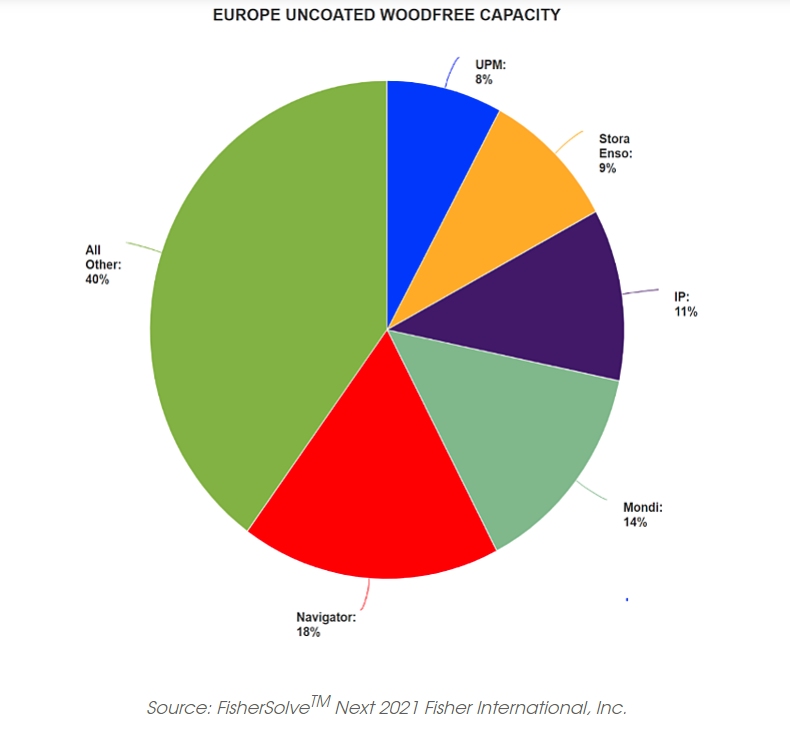

Total WFU capacity across the EU in 4Q2020 was approximately 7,900,000 MTPY. While Stora will continue producing WFU papers at its Nymölla mill in southern Sweden, the Veitsiluoto closure will result in a capacity reduction in the EU of more than 6% to 7,400,000 MTPY. A double-digit decrease in capacity seems sudden and significant, but it is likely not enough based on plummeting demand patterns for this grade.

European WFU production is highly fragmented; no single producer maintains a strong enough position to disproportionately influence market pricing. In such an environment, publicly-held companies with quarterly earnings targets and greater production elasticity are often first to react to market signals and reduce volumes.

We have witnessed a global change in copy paper consumption develop over the last 20 years as widespread access to the internet has ushered in a new digital age — a profound shift in accessibility, information gathering and knowledge sharing that is still developing at an ever-quickening pace. As a result, demand for printing and writing papers continues to decline as the digital age matures. However, the closure of offices and schools across the globe during the COVID-induced lockdowns has driven an accelerated demand destruction of this segment.

The complete article with charts and graphs is available on Forest2Mearket's website:

www.forest2market.com/blog/escalating-pressure-for-european-wfu-producers-raises-essential-questions.

SOURCE: Forest2Market

Paper Industry Newsletter

Stay on top of paper industry news

from around the world with

PaperAge's free weekly newsletter.

Delivered every Thursday.

Sign up today!